In today’s globalized community, stock markets are typically connected. What goes on on Walls Road can directly affect the Nikkei or perhaps the London FTSE 100. As a result, it’s important to stay updated around the most recent reports and tendencies in stock markets around the world. In this global financial document, we’ll discover the newest advancements from around the globe.

First off, let’s talk about the U.S. Stock Trading. Even with a string of positive revenue reviews, the industry fought to identify a foothold on Monday. It was probably because of in part to increasing concerns on the influence of your Delta version around the economy. Nonetheless, the market rebounded on Tuesday, with the Dow Jones encountering its second-finest day time of the season. It was due to strong revenue from several main firms, which includes Johnson & Johnson and Coca-Cola.

Over in European countries, the German DAX struck a fresh great as investor assurance carried on to increase. This became mostly driven by solid earnings from blue-scratch organizations including Mercedes-Benz father or mother organization Daimler and substance massive BASF. The pan-Western Stoxx 600 also increased, directed by profits in the modern technology industry.

Heading eastern, the Shanghai Composite Crawl rallied on Tuesday due to a rebound in asset prices. This uptick was motivated by confidence around China’s monetary recovery, plus the country’s on-going initiatives to overcome the cost of living. The index had previously lived with problems more than elevated regulatory scrutiny from the Chinese government around tech businesses.

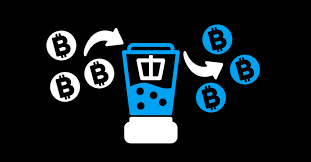

Moving forward to currencies, the U.S. buck rebounded after hitting a two-calendar month very low a week ago. It was supported by concerns within the Delta variant resulting in a flight from riskier belongings. At the same time, cryptocurrencies including Bitcoin and Ethereum carried on to struggle after last week’s market-off of. Bitcoin stayed underneath the crucial $40,000 levels, mostly as a result of regulatory problems in Asia.

Finally, let’s look at the most recent in product markets. Essential oil costs rose on Tuesday, with Brent crude lightly buying and selling above $75 a barrel. It was because of increasing demand as nations worldwide start to reopen their economies. Nevertheless, rare metal prices continued to be subdued, typically because of the fortifying You.S. money.

simple:

In all, it’s very clear the International Daily Finance still grappling using the on-going impact from the pandemic. However, good earnings studies and improving entrepreneur assurance are driving a car gains in numerous marketplaces. As usual, it’s essential to keep a near eyes on the newest information and developments in stock markets in get to help make informed expense decisions. Continue to be tuned for your after that economic record, where we’ll jump even further to the most up-to-date innovations from around the globe.