Are you currently a citizen of Ontario, Canada thinking about purchasing or create a home? Then you may qualify for a refund in the HST (Harmonized Product sales Tax) compensated on the home. However, determining the exact rebate volume could be challenging, since it is based on various factors for example the buy cost, area, plus more. But don’t worry, the HST rebate calculator might help easily simplify this process for you personally. In this particular manual, we’ll help you get with the basic principles of the HST Rebate and reveal to you how to use the HST Refund Calculator.

To begin with, allow us to determine what HST is. Harmonized Revenue Tax, or HST, is actually a taxation that combines the five% national Products or services Taxation (GST) as well as the 8Per cent Ontario Provincial Revenue Taxes (PST) right into a single taxation of 13Percent. And when getting a brand new home, customers are needed to pay HST on top of the purchase price. Even so, a refund on the part of the paid HST could be professed for major residence purchasers, based on specific problems.

When the home acquired is meant to function as the main residence for that purchaser or their quick household, it can be entitled to an HST new homes refund. The rebate may also apply to a home’s important restoration or new development, offered certain criteria are satisfied. The quantity of refund varies and is also measured upon the investment selling price, area, and other factors.

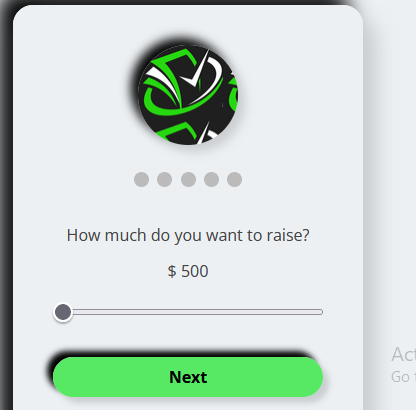

To determine the HST refund volume, one could either practice it themselves or take advantage of the HST Rebate Calculator supplied by government entities of Ontario. It really is free to use and readily available online. The HST Rebate Calculator openly asks for standard information and facts like acquire selling price, particular date of occupancy, and the location of the residence, together with other specifics. Making use of the information supplied, the calculator calculates the most new homes rebate that pertains to the homebuyer and regardless of if the greatest amount might be professed fully or in part.

It can be worth noting the HST refund assert has to be presented throughout the necessary timeframe to meet the criteria. The maximum time period made it possible for for rebate promises can vary in line with the home’s completion and occupancy day. If eligible, applicants can receive the HST refund volume through a cheque or by reduction of the amount of HST paid for during the time of buying the house.

Bottom line:

The HST rebate calculator can be a great tool which will help make simpler the process of professing an HST refund, making it simpler to determine the maximum rebate volume and also establish the eligibility in the homeowner. In case you are buying or creating a new house in Ontario, Canada, it is strongly suggested that you apply the HST rebate calculator to ensure that you get the optimum refund possible. So, keep in mind the above information and facts, and ensure you take advantage of the HST rebate calculator.