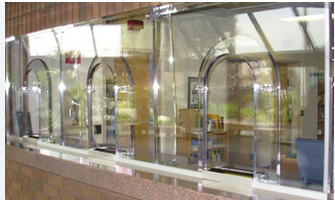

In relation to business banking, the teller windowpane remains a significant feature that allows depositors and consumers to interact with lender personnel. Tellers are responsible for executing a variety of tasks, which include processing deposits and withdrawals, managing repayments, and resolving customer teller windows concerns. With the coming of new technological innovation, some considered that the teller windowpane would grow to be out of date, but this has not been the case. The teller windows remains a vital feature that guarantees efficiency inside the consumer banking market. So, how does the teller windowpane make sure effectiveness?

1) Custom made Service: One of the primary main reasons why teller house windows continue being a crucial facet of consumer banking is because they provide personalized and customized providers to buyers. Although using ATMs has increased over time, not many are more comfortable with devices, specifically when confronted with cash. Having the capability to interact with a teller and get professional and courteous services permits consumers to feel comfortable and ensures that their business banking needs are fulfilled with superiority.

2) Improved Efficiency: Even though technology is constantly improve, the teller windowpane still offers a degree of effectiveness that should not be coordinated by models. A teller are prepared for various jobs all at once, like depositing assessments, providing bank account information, finalizing financial loans, and supplying superior customer support. This ensures that customers can complete their deals quickly and efficiently although reducing the waiting around time for some other clients in series.

3) Responsibility: Getting able to handle a teller stimulates accountability in banking. As opposed to ATMs, tellers are to blame for their purchases, ensuring that organizations can record fiscal action and guaranteeing greater security for consumers. This too assures that any discrepancies or problems might be rapidly solved and that buyers tend not to suffer negative effects from the banking operations.

4) Specific Professional services: Tellers provide specialised consumer banking and fiscal providers to consumers, supplying vital services like foreign exchange exchange and assistance with funds purchases. Such services are not always offered via machines, and necessitating them can be difficult for buyers. At the teller countertop, consumers can get professional attention centered specifically on his or her requires, guaranteeing that they have usage of all the professional services they demand.

5) Feelings of Group: Tellers help foster feelings of local community within financial institutions. When clients offer experience-to-experience with tellers, these interactions facilitate believe in, which is crucial in business banking. These interactions permit the formation of connections of have confidence in, and that optic break down of the customer’s needs and personal preferences help build long-sustained and important financial partnerships.

In a nutshell:

The teller windowpane continues to be an important part of the banking market, offering efficient solutions to customers while advertising accountability and believe in. Though technology has launched new ways of business banking, the teller counter ensures individualized and personalized services that technologies cannot match up. The teller windowpane continues to be a significant attribute in encouraging feelings of neighborhood within and away from financial halls whilst supplying specific professional services that keep consumers pleased, pleased, and dedicated.